Sustainable Bond Market

Best Practices for Responsible Investing

Sustainable Bond Introduction

I. TPEx Sustainable Bond Categories

A. Sustainable Use-of-Proceeds (UoP) Bonds

1. Green Bond: means a bond whose proceeds are used exclusively for green projects. In accordance with the Taipei Exchange Operational Directions for Sustainable Bonds, bonds with Green Bond accreditation and applied to the Taipei Exchange for TPEx trading can be listed as Green Bonds.

◎ Green project means investment in the following matters, with substantial benefit for improving the environment:

2. : means a bond whose proceeds are used exclusively for . In accordance with the Taipei Exchange Operational Directions for Sustainable Bonds, bonds with Social Bond accreditation and applied to the Taipei Exchange for TPEx trading can be listed as Social Bonds.

◎ means investment in the following matters, with substantial benefit for society:

3. Sustainability Bond: means a bond whose proceeds are used exclusively for a combination of both green projects and . In accordance with the Taipei Exchange Operational Directions for Sustainable Bonds, bonds with Sustainability Bond accreditation and applied to the Taipei Exchange for TPEx trading can be listed as Sustainability Bonds.

B. Sustainability-Linked Bonds (SLBs)

Sustainability-Linked Bond (SLB) means a bond for which the principal and interest payment terms are linked to the issuer's sustainability performance targets (SPTs). In accordance with the Taipei Exchange Operational Directions for Sustainable Bonds, bonds with SLB accreditation and applied to the Taipei Exchange for TPEx trading can be listed as SLBs.

Features: The main difference between SLBs and sustainable UoP bonds is that the funds of SLB can be used for general business purposes rather than for specific investment projects. SLBs ensure that issuers incorporate sustainability into their operational strategies and business models by setting

Example:

| An issuer selects to link the bond to greenhouse gas emissions performance. | KPI |

| The target is to reduce emissions by 30% by the end of 2025 compared to the end of 2018. | SPT |

| The coupon rate will be increased by 0.25% if the target is not met on the target observation date. | Bond Principal and Interest Payment Terms |

II. Listing procedures (For Foreign Issuers)

A. General Board NTD-Denominated Foreign Straight Bond or General Board International Bond

For issuing sustainable bonds, the foreign issuer should first apply for an approval letter from the Central Bank and then apply to the TPEx for sustainable bond accreditation. Next, the issuer should apply to the competent authority for effective registration. Once the issuer has obtained the effective registration letter, the issuer should apply to the TPEx for bond listing 4 or 5 business days prior to the listing date. After the issuance, for the UoP bonds, an annual report on the allocation of the proceeds should be disclosed regularly; for SLBs, the post-issuance report should be disclosed at least once a year from the date of issuance until the time that all SPTs have been verified.

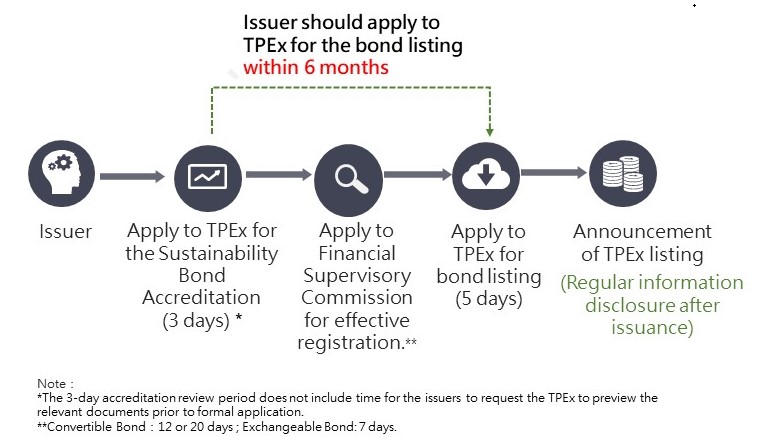

B. NTD-denominated Convertible(Exchangeable) Bonds

For issuing sustainable convertible(exchangeable)bon d, the issuer should apply to the TPEx for the sustainable bond accreditation. Next, the issuer should apply to the Financial Supervisory Commission for the issuance of convertible(exchangeable) corporate bonds effective registration. Once the issuer obtained the effective registration, the issuer should apply to the TPEx for bond listing 5 business days prior to the listing date.

B. Professional Board NTD-denominated Foreign Straight Bond

For issuing sustainable bonds, the foreign issuer shall first obtain a preliminary review opinion issued by the TPEx, and then, within 1 month from the date the preliminary review opinion is issued, apply for approval from the Ministry of Economic Affairs or a subordinate agency authorized thereby or other agency or institution delegated thereby. After obtaining a letter of approval, the issuer shall apply to the TPEx for sustainable bond accreditation and a letter of approval for TPEx trading. After obtaining the sustainable bond accreditation and the letter of approval from the TPEx, the foreign issuer shall submit relevant documentation to the Foreign Exchange Department of the Central Bank for recordation, with a copy to the TPEx. Afterwards, the issuer should apply to the TPEx for bond listing 4 business days prior to the listing date. After the issuance, for the UoP bonds, an annual report on the allocation of the proceeds should be disclosed regularly; for SLBs, the post-issuance report should be disclosed at least once a year from the date of issuance until the time that all SPTs have been verified.

C. Professional Board International Bond

For issuing sustainable bonds, the foreign issuer should first apply to the TPEx for sustainable bond accreditation. After obtaining the sustainable bond accreditation, the issuer shall submit relevant documentation to the Foreign Exchange Department of the Central Bank for recordation, with a copy to the TPEx. Afterwards, the issuer should apply to the TPEx for bond listing 4 business days prior to the listing date. After the issuance, for the UoP bonds, an annual report on the allocation of the proceeds should be disclosed regularly; for SLBs, the post-issuance report should be disclosed at least once a year from the date of issuance until the time that all SPTs have been verified.

III. Sustainable Bond Accreditation

i. Securities Types

An issuer issuing the following securities may apply to the TPEx for sustainable bond accreditation:

- Government Bonds

- Corporate Bonds(Straight Corporate Bonds, Convertible(Exchangeable) Bonds and Corporate Bonds with Warrants)

- Financial Debentures

- NTD-Denominated Foreign Straight Bonds

- International Bonds

- Beneficial Securities or Asset-Backed Securities (SLB not applicable)

- Sukuk

ii. How to Apply

An issuer applying for sustainable bond accreditation shall apply to the TPEx by submitting a Sustainable Bond Accreditation Application Form, along with a sustainable bond framework, review report and other necessary documentary proof or materials.

iii. Review Period

The TPEx should complete the review process within 3 business days from the date the application documents are delivered. Once the application documents have been reviewed and found by the TPEx to be complete and in compliance with Taipei Exchange Operational Directions for Sustainable Bonds, the TPEx may issue a sustainable bond accreditation certificate. If the review finds the application documents to be incomplete or to contain inadequate information, the TPEx shall request the applicant to supplement the documents or information within a prescribed time period. If the applicant fails to make the supplementation within that period, the TPEx shall issue a notice of rejection.

iv. Validity Period

An issuer shall, within 6 months from the issuance date of the accreditation certificate, apply to the TPEx for TPEx trading of the bonds. The accreditation certificate shall become invalid if the issuer fails to do so within that period. However, if an application for extension with good cause is filed and the application is approved by the TPEx, a 6-month, one-time-only extension may be granted.

v. Sustainable Bond Framework Required Components

| UoP Bonds | SLBs |

|---|---|

|

|

IV. Reviewer and Review Report

i. Reviewer Qualifications

A reviewer should possess the professional expertise to review Sustainable Bond Frameworks, use of proceeds, sustainability KPIs, or SPTs, and has relevant review experience.

ii. Types of Review Report

Review report means an opinion issued by a reviewer on matters relating to the Bond Framework or post-issuance reporting. Review reports may be grouped into the following types: review opinions, verification reports, certification reports, or scoring/rating reports.

iii. Review reports on Sustainable UoP Bond:

| Pre-issuance Report | Post-issuance Report |

|---|---|

A review report shall be issued by a reviewer stating that the Bond Framework meets the requirements of Taipei Exchange Operation Directions for Sustainable Bonds or of customary practice in international financial markets, according to the type of sustainable bond accreditation for which the issuer is applying. | After the proceeds of the sustainable use of proceeds bonds have been fully allocated, the issuer shall, within 30 days from the date of public disclosure of the annual financial report—unless the issuer has good cause and has applied to the TPEx for a different deadline set by the issuer—have a reviewer issue a review report on whether the status of allocation of the proceeds conforms to the Framework. |

iv. Review reports on SLB:

| Pre-issuance Report | Post-issuance Report |

|---|---|

A review report shall be issued by a reviewer stating that the Bond Framework under the preceding paragraph meets the requirements of Taipei Exchange Operation Directions for Sustainable Bonds or of customary practice in international financial markets. | The issuer of SLBs shall engage a reviewer to perform verification of its post-issuance reporting matters and issue a review report. |

V. Information Disclosures

i. Pre-issuance:

- The issuer of sustainable bonds shall disclose the content of the Bond Framework in the prospectus or another issuance document.

- The issuer shall disclose the Bond Framework and the review report on the Market Observation Post System (MOPS).

ii. Post-issuance:

| UoP Bonds | SLBs |

|---|---|

|

|