International Bond Market

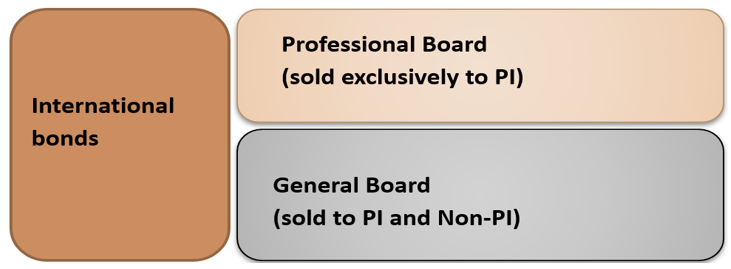

In Taiwan, the rapid market development of foreign currency denominated bonds, i.e. international bonds, is an important milestone for the globalization of the TPEx debt-related product market. By definition, bonds denominated in foreign currencies offered and issued in Taiwan or overseas by domestic and foreign issuers are called international bonds. Bonds denominated in Renminbi (RMB) are specifically called Formosa bonds. TPEx has also adopted a two-tier management system for the international bond market, which simplifies the issuance procedures for professional-grade bonds. This initiative has enhanced the breadth and depth of the international bond market, created more business opportunities for financial institutions, and met the diverse wealth management needs of domestic investors.

Two-Tier Management

Since Aug. 2013, the international bond market has been classified into two categories, the professional board and the general board. The regulation relaxation into two tiers was established with an aim to reduce issuance requirements and simplify application procedures for debt securities sold exclusively to professional investors. Meanwhile, the general board still maintains the same listing standards and requirements to protect retail investors.

Regarding detailed requirements for overseas and domestic issuers of these two boards, please refer to provisions set out in Taipei Exchange Rules Governing Management of Foreign Currency Denominated International Bonds, Regulations Governing the Offering and Issuance of Securities by Foreign Issuers, Regulations Governing the Offering and Issuance of Securities by Issuers, and other related regulations.

Continuing Obligations

- Except for exempt international bonds, issuers of both professional and general boards shall report the following information in Chinese or English on a regular basis:

- Any change in issuance data for the preceding month shall be entered into the TPEx-designated information reporting website within 10 days after the end of each month.

- Within 20 days after the completion or printing date of the annual report, an electronic file containing the annual report shall be transmitted to a TPEx-designated information reporting website.

- The issuer shall report the following information on a non-regular basis:

- Information for which prompt reporting is required by the laws and regulations of the issuer's home country or the place where its shares are traded; a branch of a foreign financial institution, or a company controlled by another company, shall additionally include information for which prompt reporting is required by the laws and regulations of the home country of its home office or another company, or of the place where the shares thereof are traded.

- The issuance, maturity, or repurchase of bonds, or the allotment of shares in accordance with regulations.

- Any change in the credit rating of the issuer or the bond.

- Information related to the liquidity providers.

- Any other matter having a material influence on the price or value of the bond.

Secondary market of the TPEx international bonds

- USD,EUR, SGD, AUD, NZD, GBP, CHF, and CAD:100,000 dollars

- JPY: 10 million Japanese Yen

- CNY, ZAR, and HKD:1 million dollars

- Same as that of EBTS for the professional board

- 1/100 of the trading unit for the general board

Two Ways Of Trading

| Electronic Bond Trading System (EBTS) | Over The Counter | |

|---|---|---|

| Eligible Trading Counterparties | International bond proprietary dealers | International bond proprietary dealers, institutional investors, and natural persons |

| Trading Hours | Outright Purchases/Sells: 9:00~13:30 Repo/ Reverse Repo: 9:00~13:30、14:00~15:00 | Outright Purchases/Sells: 9:00~15:00 Repo/ Reverse Repo: 9:00~15:00 |

| Minimum Trading Units | ||

| Settlement Day | T+3 | Within T+3 |

Day Count Fraction

| Currency | Outright Purchases/Sells | Repo/ Reverse Repo |

|---|---|---|

| USD | In accordance with the Base Prospectus or issuer’s Programme, usually 30/360 | Act/360 (subject to change according to public announcement by the TPEx) |

| AUD | In accordance with the Base Prospectus or issuer’s Programme, usually Act/Act。 | Act/Act (subject to change according to public announcement by the TPEx) |

| JPY | In accordance with the Base Prospectus or issuer’s Programme, usually Act/Act。 | Act/365 (subject to change according to public announcement by the TPEx) |

| CNY | In accordance with the Base Prospectus or issuer’s Programme, usually Act/365 or 30/360 | Act/360 (subject to change according to public announcement by the TPEx) |

| ZAR | In accordance with the Base Prospectus or issuer’s Programme, usually Act/365 or 30/360 | Act/365 (subject to change according to public announcement by the TPEx) |

| NZD | In accordance with the Base Prospectus or issuer’s Programme, usually 30/360 | 30/360 (subject to change according to public announcement by the TPEx) |

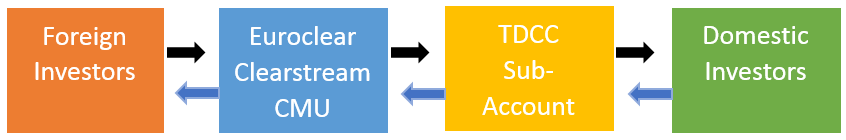

International Bond Registration And Settlement

Issuers can choose to register their debt securities with TDCC, Euroclear, Clearstream, CMU, or other clearing participants of these overseas clearinghouses for operation of custody, settlement, book-entry transfer, and repayment of principal and interest. Domestic issuers or those having no account with overseas clearinghouse can choose to do the settlement through TDCC’s sub-account in connection with Euroclear, Clearstream, and CMU as TDCC is a participant of international major clearing houses.