Market Making

Foreword

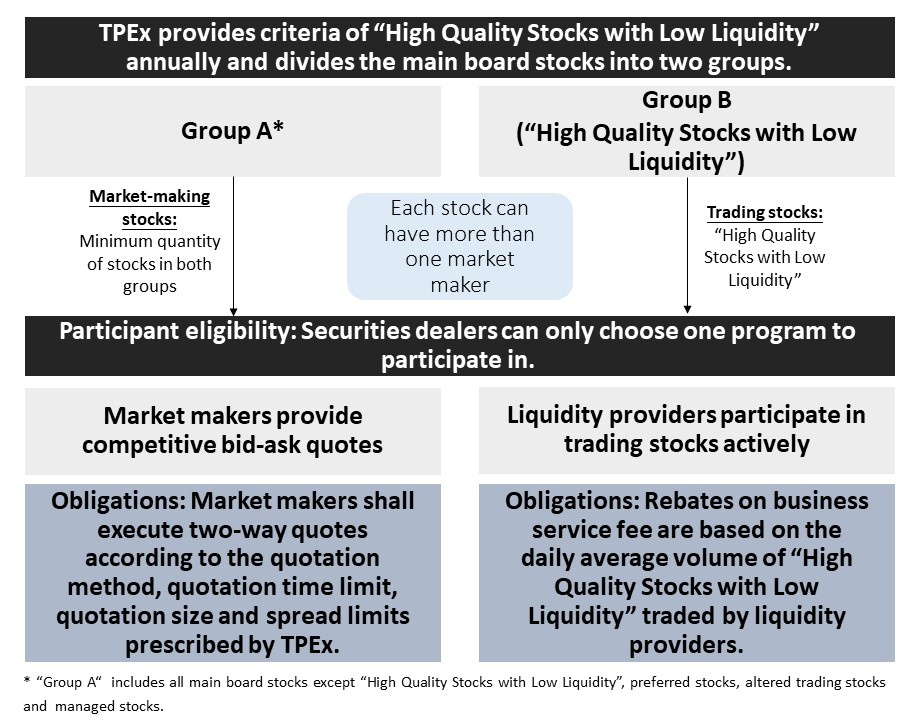

To boost the trading volume of the stocks with low liquidity, the TPEx promulgated the “Taipei Exchange Operational Rules Governing Market Makers and Liquidity Providers”, which has been approved by the Financial Supervisory Commission (FSC). The regulation will take effect on June 30, 2021.

The TPEx launches“Market Maker and Liquidity Provider Programs” and offers rebates or waivers on business service fees based on the performance of the market maker or liquidity provider.

| Item | Market Maker | Liquidity Provider |

|---|---|---|

| Eligible Participants | Securities dealers only (Each securities dealer can only apply for one program) | |

| Role | To provide competitive bid-ask quotes | To participate actively |

Introduction

I. Market Making Scheme:

The TPEx divides the main board stocks into two groups: stocks in Group B are called as ”High Quality Stocks with Low Liquidity”, meanwhile, Group A contains other main board stocks which includes all main board stocks except “High Quality Stocks with Low Liquidity”, preferred stocks, altered trading stocks and managed stocks.

Market maker needs to choose the minimum quantity, as specified by the TPEx, of stocks in Group A and Group B for which a market maker is obliged to quote a two way price on the trading system. However, liquidity providers only trade stocks in Group B.

II. Criteria of “High Quality Stocks with Low Liquidity”:

“High Quality Stocks with Low Liquidity” must meet three major requirements:

- Main board stock that has been listed on the TPEx for more than one year.

- Stocks with low daily trading volume, low volatility, and low turnover rate.

- The stock issuer had no accumulated deficit in the most recent fiscal year and distributed cash dividends within one year. The EPS of the most recent year shall be more than NT$2.