Taiwan Government Bond Index ()

I. Index name

Full Name: Taiwan Government Bond Index

II. Ground Rules

(1)Index calculation method

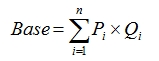

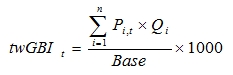

Index algorithm:

Step 1: Calculate index base value on index launch date

Step 2: Calculate index on day t

The index is set at 1000 on its launch date

where:

Pi= Price of series i government bond (price index uses clean prices (accrued interest excluded), total return index uses dirty prices (accrued interest included))

Qi= Principal amount outstanding of series i bond (face amount outstanding ÷100)

Base = Divisor, representing index base value

(2)Constituent selection criteria

- Central government bonds that repay principal in a single payment at maturity (excluding local government bonds and exchangeable corporate bonds).

- Time to maturity is longer than one year.

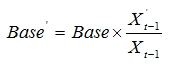

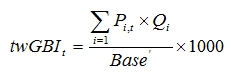

(3)Constituent adjustment

Newly issued central government bonds are added to the index and bonds with one year or less to maturity are removed from index. Index calculation in the event of constituent adjustment

Assuming the weighted market value before adjustment is:Xt-1

Assuming the weighted market value after adjustment is:X’t-1

Weighted total market value on new start date:

Index calculation starting the next day:

where

Pi=Price of series i government bond (price index uses clean prices, total return index uses dirty prices)

Qi=Principal amount outstanding of series i bond (face amount outstanding ÷100)

Base = Divisor, representing index base value

(4)Sources of prices for index compilation

Sources of prices used for index compilation are in sequence:

- The day's final transaction prices openly quoted in the Computerized Negotiation System

- Medium prices of final two-way quotes (within 10bps) in the Computerized Negotiation System for the day

- Reference closing prices provided by government bond dealers.

- Prices used for index calculation the previous day.

Notes:

“Openly quoted price” means quotes given in the Electronic Bond Trading System for which there are at least 70 potential counterparties (bond dealers). Hence an openly quoted price may be regarded as a generally executable market price that is not easily manipulated by anybody. The openly quoted transaction price should be the most credible transaction price on the market.

(5)Index disclosure frequency

The index is calculated and disclosed once after market closing each day. Also disclosed daily include prices of government bonds used for index calculation, daily changes to constituents, total market price of constituents for the day and index base value (Base) for the day.

(6)Auxiliary Information

- Weighted average coupon rate

- Weighted average years to maturity

- Weighted average yield

- Weighted average duration (modified duration)