Introduction

A TPEx ETF is an open-ended fund with its beneficiary certificates listed and traded on the Taipei Exchange. Depending on the fund's investment strategy, it can be classified into two types: 'Index ETFs (Passive ETFs)' and 'Active ETFs.

An Index ETF tracks a specific market index (e.g., the TPEx 50 Index) and aims to replicate its performance. It is passively managed because the ETF is designed to mirror the composition and performance of the underlying index without trying to outperform it. On the other hand, an Active ETF is managed by a fund manager or team of managers who make active decisions about which securities to buy, sell, or hold. The goal of an active manager is to achieve specific investment objectives or outperform a specific benchmark index.

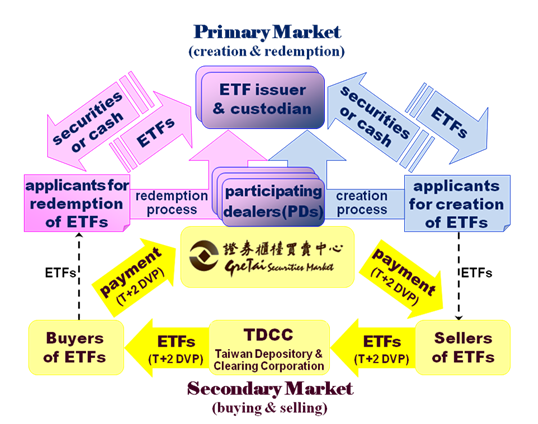

As ETFs are listed on securities markets, they can be bought and sold through brokerage accounts in the same way as stocks during trading hours at intraday prices. In addition, since ETFs are structured as open-end investment funds, they can be created and redeemed by participating dealers to meet market demand and supply. The diagram below represents the process of trading, creation and redemption of ETFs which are listed on the TPEx.

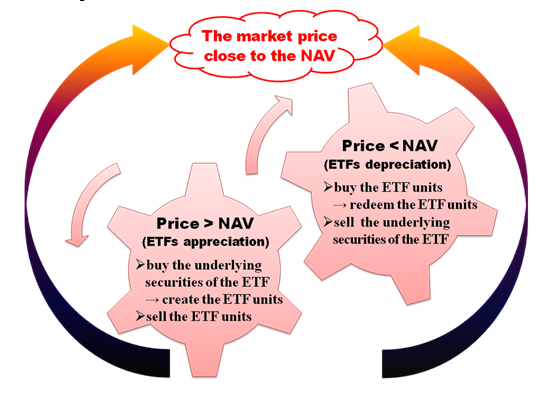

ETFs offer liquidity on both the primary and secondary market, and combine the features of stocks and open-ended index funds. The flexible structure makes ETFs a simple and powerful investment tool which providing a range of benefits including diversification, transparency, liquidity, flexibility and cost efficiency. Furthermore, through the creation and redemption process, ETFs have the capability to avoid trading at large premiums and discounts to the NAV. When the market price of an ETF is higher than the NAV, there is an appreciation, investors are able to buy the underlying securities in the secondary market, turn them over to the fund in exchange for new ETF beneficial certificate units, and sell the ETF units in the secondary market. The fact that investors sell the ETF units in the secondary market lowers the market price of the ETF and eventually reduces the appreciation gap. On the contrary, when the price of an ETF is lower than the NAV, there is depreciation, investors are able to buy the ETF units in the secondary market, turn them over to the fund in exchange for the underlying securities, and sell the underlying securities in the secondary market. The fact that investors buy the ETF units stimulates the price of the ETF and indirectly narrows the depreciation gap. The interaction between the primary and secondary market usually helps ETFs to keep the market price close to the NAV.