1.ETN brief introduction

An Exchange Traded Notes, or ETN is issued by a securities firm and listed on the securities market to track the performance of certain index returns. Investors can buy and sell ETN by way of trading stocks, or can choose to hold until maturity, and then the issuer will pay the ETN expiration value until the ETN matures. Briefly, an ETN is an investment tool that acquires index returns by stock trading, allowing small investors to enjoy diversified investment benefits or reduce investment thresholds as an innovative financial product.

2.ETN trading practice

ETN also provides investors more ways to trade than the stock market. ETN provides investors with primary market subscription and secondary market trading functions. In the primary market, investors can purchase from the securities firm that issues ETN at the time of ETN issuance, and directly purchase the ETN at the issue price. After the ETN is listed, the investor can also purchase or sell the ETN in large amounts to the issuing securities firm through the securities brokers. In addition, investors can also buy and sell ETN through the secondary market. The ETN's price fluctuation limits and tick size for the price are slightly different from the stocks. The ETN’s trading hours and trading methods are the same as the stocks.

3.ETN secondary trading mechanism

There are two ways of trading in the secondary market of ETN: system trading and negotiating over-the-counter at securities firms.

| ways of trading | Investors can buy and sell ETN with an existing stock trading account

|

|---|---|

| trading hours | Same as the stock |

| margin trading | Not allowed |

| transactions fees |

|

| price fluctuation limits |

|

| tick size | The price quote for each ETN trade shall be based on 1 ETN unit. The tick size for the price shall be 1 cent if the market price is below NT$50, and 5 cents if the market price is NT$50 or above. |

| securities transaction tax | 0.1%, the same as an ETF |

| RP/RS transactions | Not allowed |

| liquidity provider |

|

| other restrictions |

|

4.How do investors buy and sell ETN?

There are two ways for investors to buy and sell ETN. First, like buying and selling stocks, investors can use existing securities trading accounts to entrust securities brokers to place orders and settle them on the second business day after the closing date. Second, investors can apply to the issuing securities firm through the securities broker to buy or sell back ETN, just as the investor purchases the fund, but there is a certain restriction on the number of ETN if investors choose this way. Investor should read carefully the ETN prospectus.

5.ETN’s indicative value and price

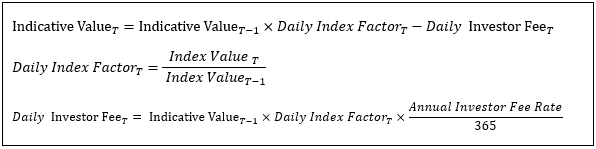

The indicative value means a value for an ETN, calculated by the issuer based on movements in the underlying index, accrued dividends, investor fees, and other relevant data. In principle, the formula for calculating the value of the indicator is as follows. However, the value of the indicator of the ETN designed by each securities firm will be slightly different. For the calculation method of the index value of each ETN, please refer to the ETN prospectus.

The price at which an investor buys or sells an ETN will vary depending on the method of trading. When an investor places an order through a securities broker in the secondary market, the transaction price is the market price of the ETN on the day. In addition, when an investor purchases or sells back to an issuing securities firm through a securities broker, the transaction price is the indicative value of the ETN on that day. The indicative value of each ETN is calculated in a slightly different way. Investor should read carefully the ETN prospectus.

6.ETN related taxes and fees

When an investor places an order through a securities broker, the brokerage fee is the same as the stock. The transaction tax is 0.1% at the time of sale. When investors sell back to the ETN to the issuer or the issuer redeems the ETN in advance, there is no need to pay securities transaction tax for the investor. As for the ETN’s capital gain tax for securities, it is exempt.

When investors purchase or sell the ETN to the issuer, the investors need to pay the fees. The cost of each ETN subscription or sale is different. Investor should read carefully the ETN prospectus.

Investors investing in ETN are required to pay the “investor fee” to the issuing securities firm. The investor fee will be directly reflected in the value of the indicative value. Each ETN’s investor fee will also be different. Investor should read carefully the ETN prospectus.

7.The benefits of investing in ETN

| 1 | No tracking error | ETN's investment returns are fully linked to the performance of the index being tracked. However, the indicative value is calculated by the return of the index with deduction of the investor fee. |

|---|---|---|

| 2 | Small diversified investment | Investing in one unit of an ETN is equivalent to investing in a basket of securities or other tracked assets. |

| 3 | Participation in specific markets | ETN tracks specific index returns, making it easier for investors to engage in thematic investments, or for general investors to enter higher-threshold markets. |

| 4 | Investment threshold is low | ETN’s price per unit is between 5 NTD and 20 NTD.If investors buy 1 ETN, they only have to pay 5,000 to 20,000 NTD. |

| 5 | Simple procedure | As long as the existing stock account is used, an ETN can be traded via the existing stock account. As long as the stock market is open, investors can engage in trading. |

| 6 | Instant and transparent information | During the trading hours, there are real-time transaction prices, and the value of real-time indicative value can be found. Investors can also obtain ETN related information through the public information observatory, our website, and the website of the issuing securities firm. |

| 7 | Low Transaction Tax | When an investor places an order through a securities broker, the brokerage fee is the same as the stock. Capital gains are tax-free, paying only 0.1% securities transaction tax at the time of sale. |

| 8 | Transparent investor fee | ETN’s issuer will announce the investor fee rate, which is directly reflected in the indicative value of an ETN. The calculation is simple and transparent, and the investor does not have to pay additional fees such as custodian fees and manager fees. Other fees like subscription fees and redemption fees, please check the ETN's prospectus. |

8.Directions for investing an ETN

- Investors should pay attention to the fact that an ETN has a maturity date, usually more than one year, but the longest maturity for an ETN cannot exceed 20 years.

- An ETN has a mandatory redemption mechanism. When an ETN rises above a certain price or falls below a certain price, even if the ETN has not expired, the issuer must also redeem the redemption, so the investor should pay attention to the mandatory redemption conditions of the ETN.

- Not every ETN’s issuer allows investors to apply subscription for the issuers. Investors should read the information about the ETN on the issuer's website and the prospectus of the ETN before investing.

9.Differences between ETN and ETF

| Item | ETN | ETF |

|---|---|---|

| listed | YES | YES |

| Subscription and Redemption | Cash ONLY | Cash/ in-kind creation and in-kind redemption |

| Fee | LOW | LOW |

| Maturity | YES | NO |

| Credit risk of issuer | YES | NO |

| Tracking Error | NO | YES |

10.ETN’s risk

The risks that investors may face when investing in ETN are credit risk of the issuing securities firms, non-guaranteed capital, discounted premium risk, liquidity risk, and early redemption risk of securities firms and other risks. Investors should refer to the risk notice example and the each ETN’s prospectus.