Overview

I. Foreword:

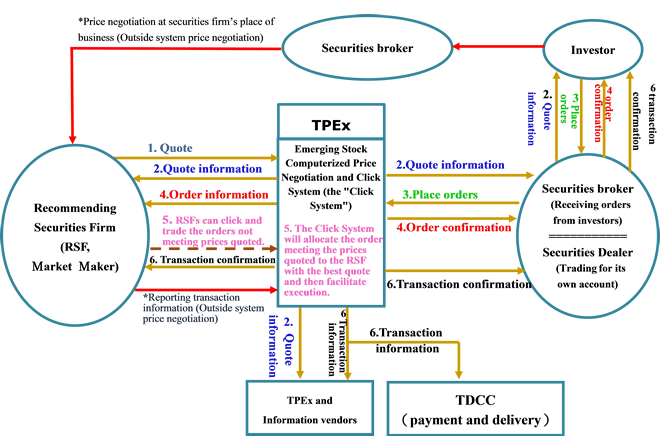

The Emerging Stock Board (ESB) is established for investors to trade unlisted stocks efficiently in a well-regulated environment. Therefore, there are no conditions, such as the requirement of the applying company’s profitability and dispersion of shareholding. No review procedures similar to those for TWSE/TPEx listing of stocks are set. A company that has been recommended by two or more Recommending Securities Firms (RSFs) will be eligible for ESB registration. Trades of Emerging stocks are dominated by bid and ask quotations of RSFs. RSFs are obligated to continuously quote bid and sell order quotations, and the counterparty of an executed trade of Emerging stocks must be the RSFs thereof. Trades cannot be executed between investors.

II. Trading Procedures of Emerging stocks:

III. Trading Rules:

- Trading hours: 9:00 A.M. - 3:00 P.M.

- Daily price fluctuation limit: No fluctuation limit.

- Trade unit: 1 share.

- Tick: The fixed tick is same of that of TWSE (TPEx)-listed stocks, where the tick will be divided into 6

different brackets based on the stock price (as in the following table).

Price Brackets for Emerging Stocks Tick 1 Stock price < NT$10 NT$0.01 2 NT$10 ≦ Stock price < NT$50 NT$0.05 3 NT$50 ≦ Stock price < NT$100 NT$0.1 4 NT$100 ≦ Stock price < NT$500 NT$0.5 5 NT$500 ≦Stock price < NT$1,000 NT$1 6 Stock price ≧ NT$ 1,000 NT$5 RSFs’ obligation of Emerging Stocks market making:

- RSFs’ quotes are all firm quotes

- Continuous quotes: During the trading hours, a new quote shall be offered within three minutes after the RSF’s quote is executed or canceled.

- Bid-ask quote: In principle the RSF shall offer a quote comprising a “Bid” and an “Ask.”

- The spread between the bid and ask quoted by the RSF shall not exceed five percent of the ask price.

- The quote volume shall not fall below the minimum quantity:

(1) For quoted price < NT$20, the minimum quantity is 5,000 shares.

(2) For NT$20 ≦ quoted price < NT$100, the minimum quantity is 3,000 shares.

(3) For quoted price ≧ NT$100, the minimum quantity is 2,000 shares.

- Price negotiation through the Emerging Stock Computerized Price Negotiation and Click System(the Click System): If the investor’s price reaches the range of quotes from the RSFs (trading order meeting the price quoted: Investor’s buy order ≧ RSF’s ask quote; Investor’s sell order ≦ RSF’s bid quote), the Click System will allocate the order to the RSF with the best quote; if the price does not reach the range of quotes from the RSFs (trading order not meeting the price quoted: Investor’s buy order < RSF’s ask quote; Investor’s sell order > RSF’s bid quote), the RSFs are not obliged to execute the transaction.

Price negotiation at securities firm’s place of business (Outside system price negotiation): When the RSF and the securities broker conduct the price negotiation directly, the trading volume shall be 100,000 shares or higher or the trading value shall be NT$5 million or higher, and any of the following conditions shall be met:

- A brokered buy-sell trade is executed on the same trading day and the counterparty is not an insider of such ESB companies.

- Other matters approved by TPEx.

※Trading methods of outside system price negotiation on Emerging Stocks are summarized as below:

Counterparty Type of Transactions Description Rules about Quantity/Amount Rules about Execution Price RSF and customers of securities broker A brokered buy-sell trade is executed with a RSF on the same trading day (either of the counterparties is not an insider of such ESB companies). Where the trading volume or trading value meet the criteria, the investor may engage the securities broker to negotiate with RSF. A trading volume is no less than 100,000 shares or a trading value is no less than NT$5 million or more. 1. The spread between the execution price and the quote offered by the RSF then shall not exceed ten percent.

2. For a brokered buy-sell trade, the execution price shall be between the bid quote and ask quote offered by the RSF.Other matters approved by TPEx. Out-trades by securities brokers A securities broker handles the out-trade through its error account by a repurchase or resale of equal volume. None RSF and securities dealer intending to participate in recommendation. Outside system price negotiation with securities dealer intending to participate in recommendation A securities dealer intending to participate in recommendation can acquires the shares by outside system price negotiation. A trading volume is no less than 30,000 shares. RSF and other RSF. Negotiate price directly with other RSFs. Must comply with RSF’s internal operating rules for the trading of Emerging stocks. None Trading Halt for Individual Emerging stock: In light that no fluctuation limit is set on Emerging stocks, and in order to prevent investors from undergoing trading risks derived from irregular price volatility, when the spread between weighted average trading price of individual Emerging stock during the trading session and on the previous business day reaches fifty percent (inclusive) or higher, trades of such Emerging stocks will be suspended till the end of the trading hours on that day, and trading will be resumed on the next business day. However, any of the following special conditions will be excluded from the trading halt for individual Emerging stock:

- From the next business day following the TPEx’s public announcement of the suspension or termination of TPEx trading of the stock.

- The given business day is the commencement date of ex-dividend or ex-rights trading of the stock.

- The given business day is the date on which trading for the stock will resume after a capital reduction.

- The given business day is the date on which trading for the stock will resume after carrying out procedures for issuance of new replacement shares due to a change of par value.

- The given business day is one of the first five business days on which the stock begins to be traded on the TPEx.

- The weighted average trading price of the stock of the preceding business day is below NT$1.

- Other exempted circumstances as announced by the TPEx.

- The price range of orders: If an order price is 30% higher or lower than the average price of the best bid and ask quotations among the recommending securities firms at the time of placing the order (the base price), the order will be rejected. Provided that it is not applicable for the first five business days on which the stock begins to be traded on the TPEx. (This amendment is effective on 17 Oct, 2022.)