The Taipei Exchange (TPEx) established the Emerging Stock Board (ESB) in the year of 2002, which originally aimed to address the problems with illegal trading of private stocks. Nowadays, ESB has developed as a preliminary market before IPO, playing an important role in the capital market. Registering on ESB can help companies to become familiar with laws and regulations related to the securities market, to raise their profile and visibility, and to discover reasonable share prices in IPO procedures. Moreover, ESB helps nurture emerging enterprises with good potential in the way of incorporating with advisory role of recommending securities firms. With the required advising and counseling during registration period, the ESB companies make improvement in the quality of their internal control system and compliances.

In support of the innovative companies to enter into capital market, TPEx launched Pioneer Stock Board (PSB) in Q3 2021 and formed the former ESB into PSB together with Emerging Stock Market (ESM). Enterprises applied for registering on PSB could adopt simplified public issuing procedure which was favorable for them in their journey to the capital market.

To improve ESM and create a more friendly market environment, TPEx consolidated PSB and ESB which make ESM back to one single board. The new change of ESM came into effect from 1 January 2024.

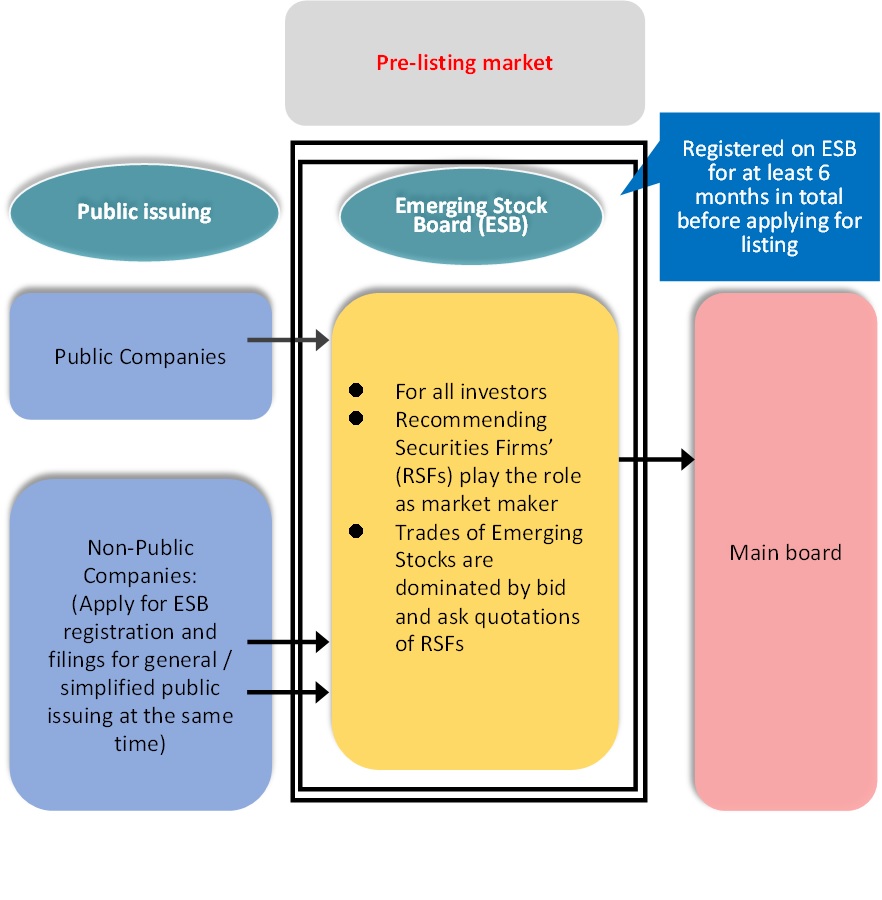

Concerning the above mentioned simplified public issuing procedure helped enterprises reducing the preliminary costs and time for going public, non-public enterprises (either domestic or foreign)could apply for ESB registration and summit the filing documentation for public issuing (including general public issuing and simplified public issuing) at the same time from the year 2024. The market structure shows as below:

3 ways to apply for registering on ESB:

| Application Entity | Public Companies | Non-Public Companies | |

|---|---|---|---|

| Application Procedure | Enterprises complete the general public issuing procedure before applying for registering on ESB. | The application for ESB registration and filings for general public issuing can be submitted to TPEx at the same time. | The application for ESB registration and filings for simplified public issuing can be submitted to TPEx at the same time. |

| Registration criterion | No requirements on duration of corporate existence, profitability, and shareholding dispersion. | ||

| Applicable industries | No specific industries | ||

| Review procedure | Documentation review | ||

| Difference between filing documents for public issuing |

|

|

|

| Advisory recommending securities firm(RSF) |

| ||

| Restriction on investors | None | ||

| Trading mechanism |

| ||