Regulations:

- Taipei Exchange Rules Governing the Review of Securities for Trading on TPEx

- Taipei Exchange Rules Governing the Review of Emerging Stocks for Trading on TPEx

- Application Documents for Listing on the TPEx

- ESB registration application documents

Information:

- TPEx/ESB Listing (Registration) main conditions:

Item General Stock Emerging Stocks Applicable industries No restriction. No restriction. Company Scale For domestic companies, a paid-in capital of NT$50 million or more.

For foreign companies, net worth audited or reviewed by a CPA for the most recent period is equivalent to at least NT$100 million.No restriction. Duration of Corporate Existence Have been registered for no less than 2 full fiscal years. (Note 1) No restriction. Financial Requirements Shall meet one of the criteria: (Note 1) - Profitability i. The shares issued by the company with par value of NT$10 per share.

- Most recent fiscal year: the ratio shall be more than 4%, and there shall be no accumulated deficit.

- The last 2 fiscal years: the ratio shall be more than 3% in each year; or an average of 3% in the 2 years and the ratio of the most recent year is better.

- Most recent fiscal year: the ratio shall be more than 2%.

- The last 2 fiscal years: the ratio shall be more than 1.5% in each year; or an average of 1.5% in the 2 years and the ratio of the most recent year is better.

- Net worth, operating revenue and cash flows from operating activities Shall meet each of the following requirements:

- Net worth for the most recent period shall be not less than NT$600 million and two-third of the share capital. (Note: For stocks with no par value or a par value per share other than NT$10, the share capital shall include 'capital surplus – Issuance of ordinary shares’)

- Operating revenue from main business for the most recent fiscal year shall be not less than NT$ 2 billion and greater than that for the immediately preceding fiscal year.

- Cash flows in the most recent fiscal year shows a positive net cash flow from operating activities.

The ratio of income before tax to capital shall meet one of the following requirements, and the income before tax of the most recent fiscal year shall not be less than NT$4 million, and there shall be no accumulated deficit:

The ratio of income before tax to net worth shall meet one of the following requirements, and the income before tax of the most recent year shall not be less than NT$4 million, and there shall be no accumulated deficit:No restriction. Dispersion of Shareholdings Excluding company insiders and any juristic persons in which such insiders hold more than 50% of the shares, the number of registered shareholders shall be at least 300, and the total number of shares they hold shall be 20% or greater of the total issued shares, or at least 10 million. (This requirement could be met after the pre-listing capital infusion.) No restriction. Lockup of the Shares The directors and the shareholders holding 10% or more of the issued shares of the registrant shall deposit all their shareholdings in central custody. One half of those shares deposited in central custody may be withdrawn after the lapse of six-month period starting the listing date thereof; the remaining shares may be withdrawn after the lapse of a one-year period starting the listing date thereof. (Note 2) No restriction. Functional Committee The registrant shall have a compensation committee and an audit committee in place. The registrant shall have a compensation committee in place. Independent Directors The registrant shall appoint independent directors, not less than three in number and not less than one of the total number of directors. The registrant shall appoint independent directors, which should not less than two in number and not less than one-fifth of the seats in Board of Directors. However, domestic non-public companies that file for public issuing and apply for registration on ESB at the same time shall pledge to hold shareholders meeting and appoint independent directors no more than 6 months after registering on ESB and to fill more than half of the seats at the compensation committee with independent directors. Board Members The board members shall not be single gender. No restriction. Chief Corporate Governance Officer A chief corporate governance officer shall be appointed in accordance with “Taipei Exchange Directions for Compliance Requirements for the Appointment and Exercise of Powers of the Boards of Directors of TPEx Listed Companies”. No restriction. Recommending Securities Firms The registrant shall have received written recommendations by 2 or more Recommending Securities Firms (RSFs), one of which is designated as the lead RSF, and the other(s) as co-RSF(s). Same as on the left. Shareholder Services Provider The registrant shall engage a professional shareholder services agent in the ROC to handle shareholder services matters. Same as on the left. Required Advisory / Trading period The issuer’s stock shall have been traded on the ESB for more than 6 months. For foreign companies, the issuer’s lead RSF shall have filed the advisory progress for more than 6 months or the issuer’s stock shall have traded on the ESB for more than 6 months. Must have signed an advisory contract with securities firms and submitted the ESB Checklist for the company for the most recent 1 month. Stocks in Dematerialized Form The stocks and bonds offered and issued (including private placements) shall be in dematerialized. Same as on the left. Note 1: The Technology-Based Enterprises, or Cultural and Creative Enterprises may be exempted from these requirements. If it is a Technology-Based Enterprises, its net worth shall not be less than two-thirds of the share capital shown in the latest CPA-audited and attested or reviewed financial report. Please refer to Technology Based Enterprises or Cultural and Creative Enterprises Section.

Note 2: Otherwise provided for Technology- Based Enterprises, Cultural and Creative Enterprises, enterprises adopting financial requirements of “Net worth, operating revenue and cash flows from operating activities", and securities investment trust companies. (Please see Article 3, Paragraph 1, Item 4 of the Taipei Exchange Rules Governing the Review of Securities for Trading on the TPEx)

- Emerging Stocks Board(ESB) Registration Procedures:

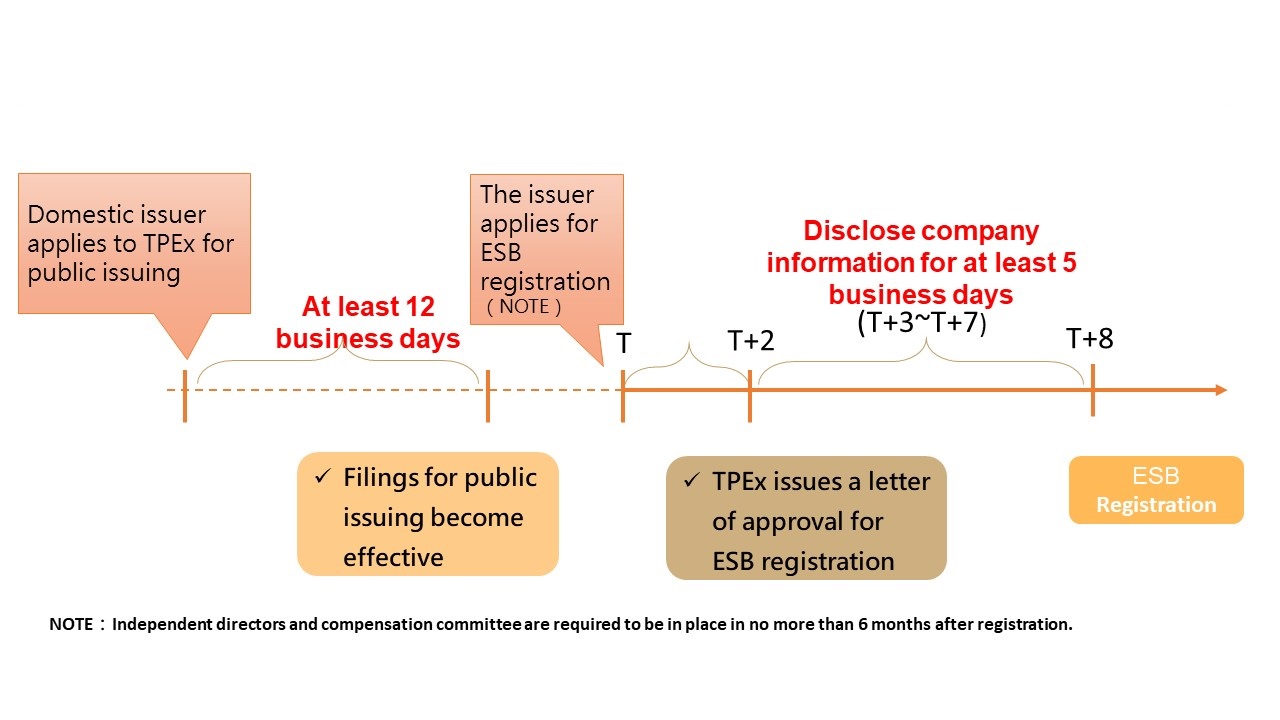

- Public Companies Apply for ESB Registration Procedures

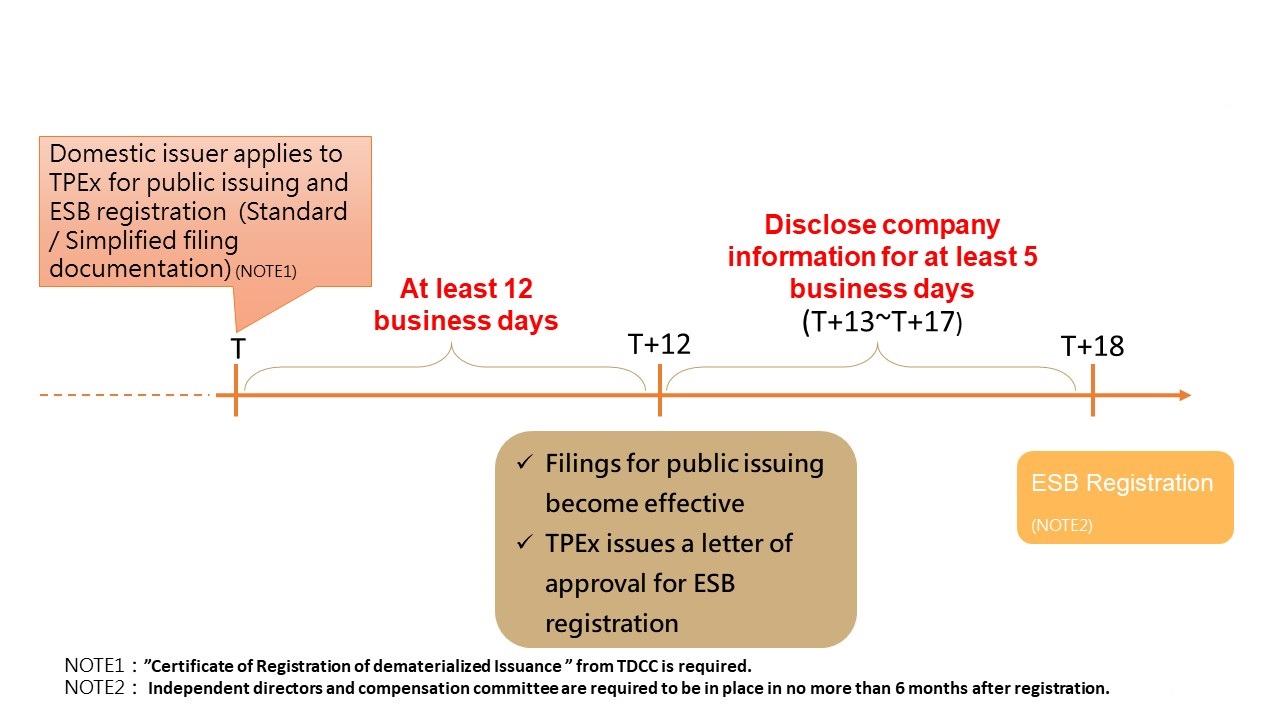

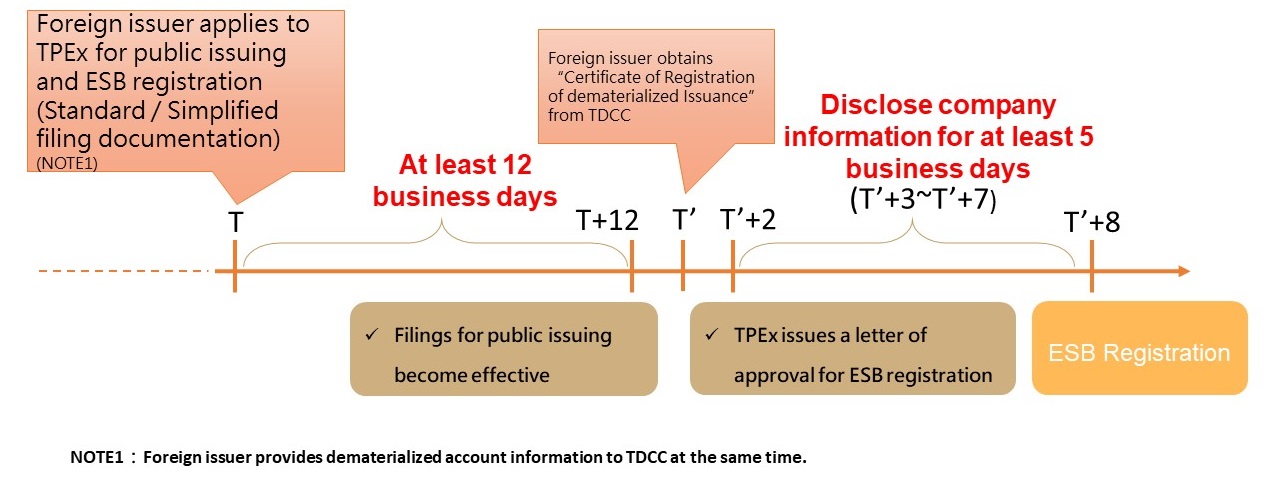

- Non-Public Companies Apply for ESB registration and Filings for Public Issuing Procedures

- Domestic Issuer

- Foreign Issuer

- Domestic Issuer

- Public Companies Apply for ESB Registration Procedures

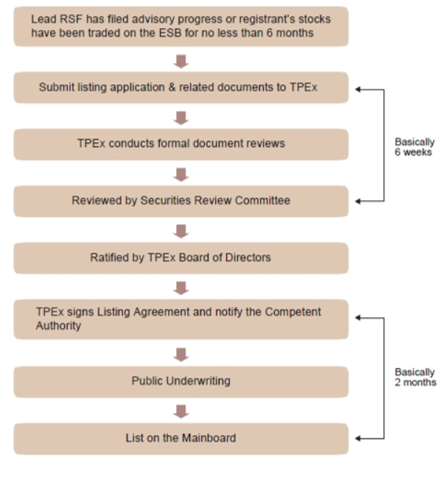

- TPEX Mainboard Listing Procedures:

- Related laws and information:

- Domestic Enterprises

- ESB Registration : Taipei Exchange Rules Governing the Review of Emerging Stocks for Trading on the TPEx

- Mainboard Listing : Taipei Exchange Rules Governing the Review of Securities for Trading on the TPEx

(Please refer to Law Source Retrieving System of Stock Exchange and Futures Trading for related regulations)

- Foreign Enterprises

- Foreign Issuer’s Information

- ESB Registration : Taipei Exchange Rules Governing the Review of Emerging Stocks for Trading on the TPEx

- Mainboard Listing : Taipei Exchange Rules Governing the Review of Foreign Securities for Trading on the TPEx

(Please refer to Law Source Retrieving System of Stock Exchange and Futures Trading for related regulations)

- Domestic Enterprises