1. Foreword

TPEx-BOC Offshore RMB Bond Index is a market value weighted bond index in which constituents are selected from TPEx-listed Formosa bonds ranked by their issue size and in consideration of their tenor and issuer. The index is designed to illustrate the overall performance of TPEx Formosa Bond Market.

2. Management Responsibility

Section 2.1 Index Advisory Committee and Committee Members

- An Index Advisory Committee is established for the review of the TPEx-BOC Offshore RMB Bond Index and to give advice on changes to the index ground rules and related matters.

- The Index Advisory Committee comprises seven members, including three internal members from Taipei Exchange (“TPEx”) and four external members. The chairperson of the Committee will be appointed by the TPEx. The chairperson will chair and preside over committee meetings, and represent the committee during its recess.

Section 2.2 Secretarial Unit of the Index Advisory Committee

- The secretary of the Index Advisory Committee will be assigned by the TPEx and assist in the committee operations. The secretarial unit is responsible for maintaining the records of monthly constituent adjustment and changes to constituents, and for publishing in a timely manner news on constituent changes.

- In the periodic adjustment of constituents, the secretarial unit will add or delete constituents in accordance with Section 5.2 herein, and publish the results of monthly adjustments.

Section 2.3 Index Calculation and Management

- The TPEx-BOC Offshore RMB Bond Index includes NTD-denominated TPEx-BOC RMB Bond Index and RMB-denominated TPEx-BOC RMB Bond Index.

- TPEx is responsible for the design, calculation and information transmission of TPEx-BOC Offshore RMB Bond Index.

- TPEx examines the Index every month, updates its constituents and weighting according to the index ground rules and makes changes to constituents after review.

- TPEx will keep records on the market value of all constituents.

3. Selection of Constituents

Section 3.1 Eligibility

The constituents of the TPEx-BOC RMB Bond Index are selected from Formosa bonds listed on TPEx and with tenor longer than six months (inclusive) and less than ten years (inclusive).

Section 3.2 Prices of Constituents Used for Index Calculation

The RMB-denominated TPEx-BOC Offshore RMB Bond Index is calculated using directly the prices of constituents; the NTD-denominated TPEx-BOC Offshore RMB Bond Index is calculated using the prices of constituents in NTD converted based on the exchange rate between NTD and RMB instantly provided by information provider.

Section 3.3 Constituent Selection Criteria

- Issue size

The principal amount outstanding of the bond is 500 million RMB or higher. - Credit rating

The bond issuer has a credit rating of A+, A, or A- from Standard & Poor’s or A1, A2 or A3 from Moody’s (if the issuer has credit rating from both Standard & Poor’s and Moody’s, the credit rating assigned by the former will be used in selection). - Principal repayment and interest accrual

The bond shall offer a fixed rate and repay principal in a single payment at maturity (excluding zero-coupon bonds and bonds with warrants).

4. Index Calculation Method

Section 4.1 Calculation frequency

The TPEx-BOC Offshore RMB Bond Index is calculated in real time and published every 5 seconds during the trading hours of TPEx based on the latest trading prices of constituents. A closing index will be calculated after market closing each day.

Section 4.2 Sources of prices

The sources of prices used for index calculation are in sequence:

- The real-time transaction prices from the TPEx international bond system or reported by securities firms.

- Fair value (dirty price) provided by TPEx.

The TPEx fair values are derived from the sum of discounted cashflows based on the zero-coupon yield curves obtained via bootstrapping from the Formosa bonds yield curves constructed using the quotes given by bond dealers.

Section 4.3 Index algorithm

4.3.1 Index calculation

- RMB-denominated index

- Calculation formula

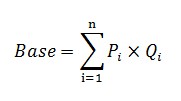

where

Pi,tis the dirty price of constituent i per $1 face value at time t

Qi,tis the principal amount outstanding of constituent i at time t

Baseis the index base value determined by the total market value of all constituents on the index base date

- Base adjustment

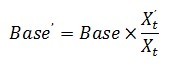

When index calculation is disrupted due to constituent adjustment and interest payment, its base is adjusted as follows:

Xt is the total market value before adjustment

X'tis the total market value after adjustment

Base’is the index base value on a new base date

If the prices of the constituents stay unchanged, the index will stay unchanged when there is a constituent adjustment or interest payment:

- NTD-denominated index

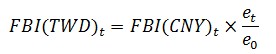

- Calculation formula

where

et is the exchange rate between NTD and RMB at time t

e0 is the exchange rate between NTD and RMB on index base date - Base adjustment

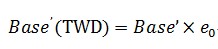

The NTD index base value is adjusted as follows when the RMB index base value is adjusted:

where

Base’ is the RMB index base value

e0 is the exchange rate between NTD and RMB on index base date

5. Review of Constituents

Section 5.1 Review dates

- The constituents of TPEx-BOC Offshore RMB Bond Index are reviewed on the last trading day of each month. Any change to constituents will become effective on the first trading day of each month.

- The monthly constituents review by the Secretarial Unit of the Index Advisory Committee will be conducted in accordance with Section 3 – Selection of Constituents.

Section 5.2 Inclusion and removal of constituents

- To ensure that the index is representative of the Formosa bond market and to maintain the stability of TPEx-BOC Offshore RMB Bond Index constituents, the Secretarial Unit of Index Advisory Committee will review the index constituents periodically every month and add Formosa bonds that are not yet included in the index but meet the selection criteria provided in Section 3 to the index and remove existing constituents that have less than six months to maturi

- The Secretarial Unit will also add all newly issued Formosa bonds that meet the selection criteria provided in Section 3 to the index; when a constituent has its issuer credit rating adjusted and no longer meets the selection criteria or when the principal amount outstanding of a constituent is less than 500 million RMB, such constituent will be removed from the index.

6. Changes to Constituents

- When a constituent has its trading suspended by TPEx, it will be kept in the index using its fair value published by TPEx daily as calculation basis until the next constituent adjustment day, on which the constituent will be removed.

- When a constituent bond is removed from the index due to trading suspension but is later on reinstated for trading, the bond will be considered for inclusion in the index during the monthly review according to Section 5 if it meets the selection criteria provided in Section 3.

7. Modification to the Ground Rules and Exceptions

- When the Index Advisory Committee or the Secretarial Unit suggests modification of the ground rules or making an exception to the ground rules, the chairperson of the Advisory Committee will present the suggestion to the committee meeting for decision. If matter is of an urgent nature, the chairperson is authorized to represent the committee to make an exception approval. However the committee members should be promptly notified of the exception approval and the matter should be presented in the committee meeting.

- If an exception approval is given in accordance with the preceding paragraph, the exception should not be considered as a precedence when the Advisory Committee makes decisions in the future.

- A major modification to the ground rules that has been passed by the Advisory Committee and published will not become effective until it is confirmed in the next Advisory Committee meeting so index users and market participants will be given time to make comments. However only the Advisory Committee has the authority to modify the index ground rules.