| Item | General Stock | Emerging Stocks | |

|---|---|---|---|

| Applicable industries | No restriction. | No restriction. | |

| Company Scale | For domestic companies, a paid-in capital of NT$50 million or more. For foreign companies, net worth audited or reviewed by a CPA for the most recent period is equivalent to at least NT$100 million. |

No restriction. | |

| Duration of Corporate Existence | Have been registered for no less than 2 full fiscal years. (Note 1) | No restriction. | |

| Financial Requirements | Shall meet one of the criteria:(Note 1)

|

No restriction. | |

| Dispersion of Shareholdings | Excluding company insiders and any juristic persons in which such insiders hold more than 50% of the shares, the number of registered shareholders shall be at least 300, and the total number of shares they hold shall be 20% or greater of the total issued shares, or at least 10 million. (This requirement could be met after the pre-listing capital infusion.) | No restriction. | |

| Lockup of the Shares | The directors and the shareholders holding 10% or more of the issued shares of the registrant shall deposit all their shareholdings in central custody. One half of those shares deposited in central custody may be withdrawn after the lapse of six-month period starting the listing date thereof; the remaining shares may be withdrawn after the lapse of a one-year period starting the listing date thereof. (Note 2) | No restriction. | |

| Functional Committee | The registrant shall have a compensation committee and an audit committee in place. | The registrant shall have a compensation committee in place. | |

| Independent Directors | The registrant shall appoint independent directors, not less than three in number and not less than one of the total number of directors. (Note 3) | The registrant shall appoint independent directors, which should not less than two in number and not less than one-fifth of the seats in Board of Directors. However, domestic non-public companies that file for public issuing and apply for registration on ESB at the same time shall pledge to hold shareholders meeting and appoint independent directors no more than 6 months after registering on ESB and to fill more than half of the seats at the compensation committee with independent directors. | |

| Board Members | The board members shall not be single gender. (Note 3) | No restriction. | |

| Chief Corporate Governance Officer | A chief corporate governance officer shall be appointed in accordance with “Taipei Exchange Directions for Compliance Requirements for the Appointment and Exercise of Powers of the Boards of Directors of TPEx Listed Companies”. | No restriction. | |

| Recommending Securities Firms | The registrant shall have received written recommendations by 2 or more Recommending Securities Firms (RSFs), one of which is designated as the lead RSF, and the other(s) as co-RSF(s). | Same as on the left. | |

| Shareholder Services Provider | The registrant shall engage a professional shareholder services agent in the ROC to handle shareholder services matters. | Same as on the left. | |

| Required Advisory / Trading period | The issuer’s stock shall have been traded on the ESB for more than 6 months. For foreign companies, the issuer’s lead RSF shall have filed the advisory progress for more than 6 months or the issuer’s stock shall have traded on the ESB for more than 6 months. | Must have signed an advisory contract with securities firms and submitted the ESB Checklist for the company for the most recent 1 month. | |

| Stocks in Dematerialized Form | The stocks and bonds offered and issued (including private placements) shall be in dematerialized. | Same as on the left. | |

| 2. Emerging Stocks Board(ESB) Registration Procedures: |

|---|

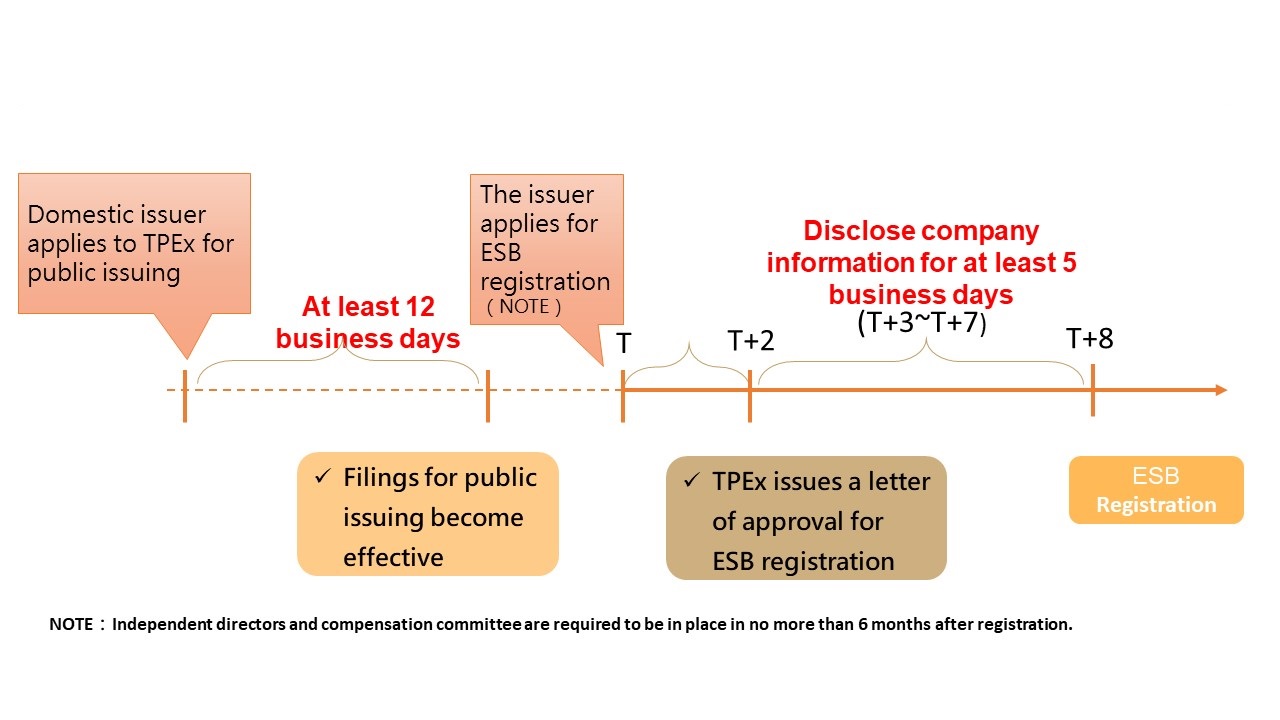

| (1) Public Companies Apply for ESB Registration Procedures |

|

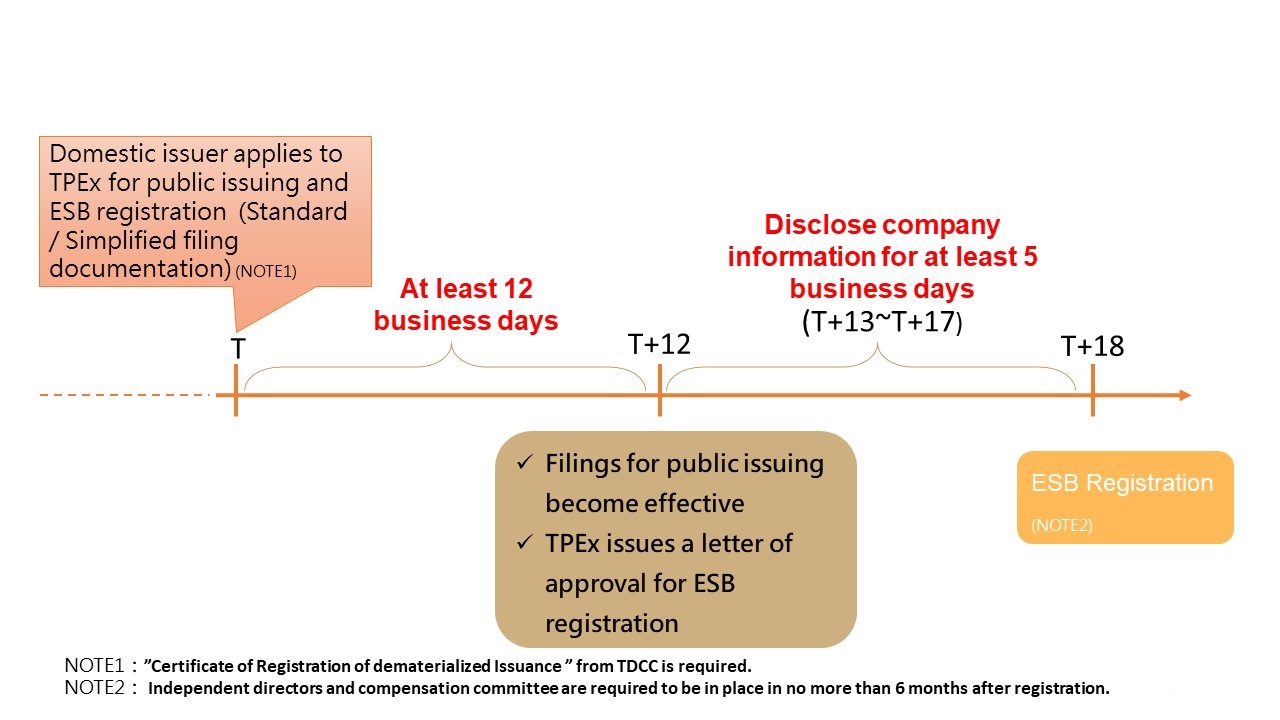

| (2) Non-Public Companies Apply for ESB registration and Filings for Public Issuing Procedures |

| A. Domestic Issuer |

|

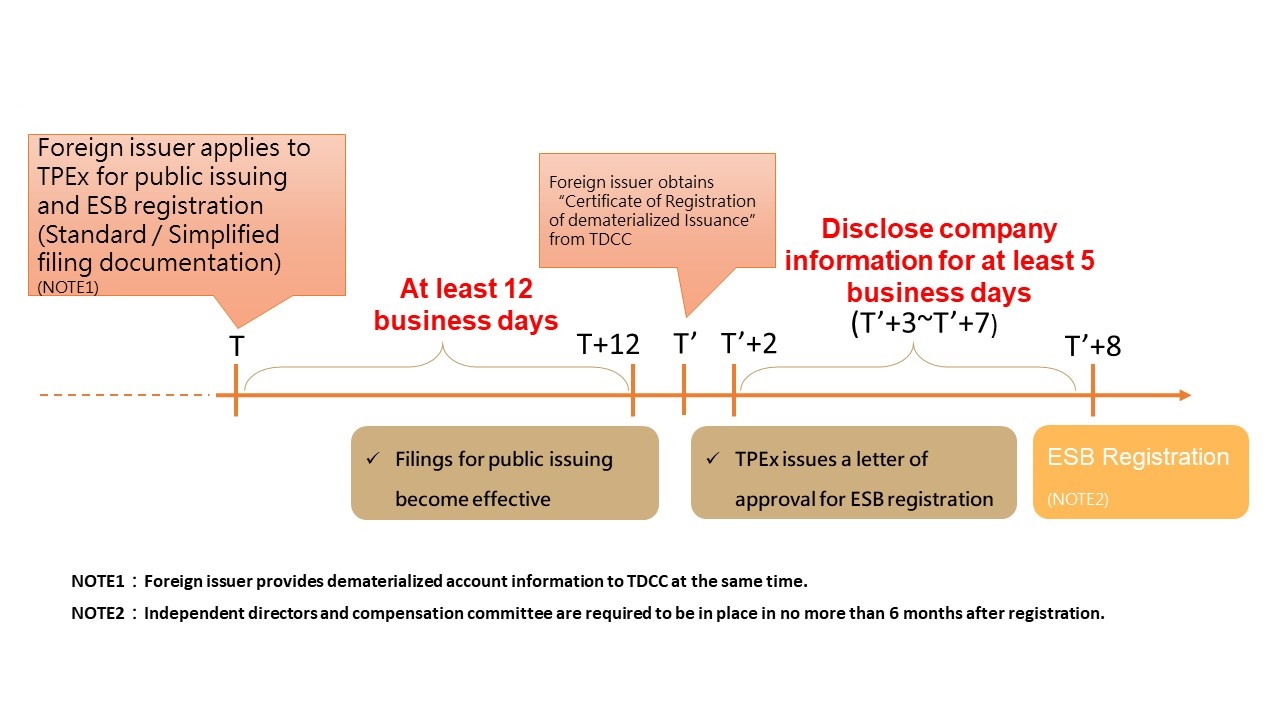

| B. Foreign Issuer |

|

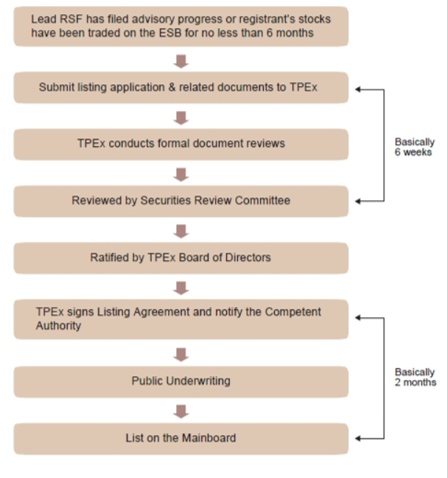

| 3.TPEX Mainboard Listing Procedures: |

|---|

|

| 4. Related laws and information: |

|---|

Domestic Enterprises

(Please refer to Law Source Retrieving System of Stock Exchange and Futures Trading for related regulations) Foreign Enterprises

(Please refer to Law Source Retrieving System of Stock Exchange and Futures Trading for related regulations) Featured Industry |