-

Mainboard

- TPEx Mainboard Listing Requirements and Procedures

- Market Information System

-

After-Hour Trading Information

- Daily Stock Quotes

- The Indices Summary

- Market Highlight

- Summary

- Daily Close Prices (not incl. After-hour Fixed-price Trading)

- Daily Volume & Index

- Stock Daily Info

- Short Sale Info

- After-Market Info

- Odd-lot Trading

- Stock P/E Ratio(By Date)

- Stock P/E Ratio(By Stock)

- Info for Advances/Declines Unavailable for First Five Days

- Information regarding altered trading, periodic trading, managed stocks, suspended stocks

- Daily Trading Statistics of Securities Firms

- Daily TPEx Trading Statistics of Securities Firms

- Price Table

- Intraday Indices and Most Active Stocks Info.

-

Trading System

- Trading Mechanism Introduction

- Market Maker

- Objects and Statistics for Day Trading

- Continuous Trading

- Intraday odd lot trading

- Daily price fluctuation limit

- Information disclosure before market opening and closing

- Fixed-Term / Fixed-Amount Trading

- Joint Responsibility System Clearing and Settlement Fund

- TPEx’s PFMI Disclosure Report and Public Quantitative Disclosure

-

Most Active Historical Stocks Info.

- Daily Stock Market Value List

- Most Active Turnover Ratio

- Most Active Trading Volume

- Most Active Trading Amount

- Most Active Avg. Trading Volume

- Most Active Avg. Trading Amount

- Most Active Share Volume

- Most Active Trading Amount

- Most Active Advanced

- Most Active Declined

- Stock Weights by Trade Value/Volume

- PE Ratio Listing

- Weekly Stock Market Information

-

Margin Trading

- Margin Trading Suspension Report

- Adjusting Margin Requirements

- Competitive bid borrowing

- Short sale Balance of Margin Trading and SBL

- Highlights of margin trading balance

- Securities exempted from SBL short selling price constraint

- Margin trading announcement

- Margin Balance

- Collateral balance of securities business money lending

- Margin and short usage

- Margin and short balance - ranking by increase and decrease

-

Major Institutional Trading

- Foreign & Institutional Investors Trading Summary

- Foreign & Institutional Investors Trading Detail

- Dealer Net Buy and Sell

- Domestic Inst. Net Buy and Sell

- Foreign & Mainland Area Investors' Trading Detail

- Foreign & Mainland Area Investors' Trading and shareholding(Chinese Only)

- OC/FI Trading and Shareholding (by Stock)

- OC/FI Trading and Shareholding (by Stock Sectors)

- SBL Information

- Block Trading

-

Market Statistics

- Indicators of TPEx

- Securities Trading Daily Statistics

- Securities Trading Monthly Statistics

- Securities Trading Yearly Statistics

- Yearly Trading Value/Volume of Individual Securities

- Indices Monthly Statistics

- Monthly Trading Value/Volume of Individual Securities

- Securities Firms Monthly Statistics

- Monthly TPEx Regular/Emerging Listed Company Report

- Quarterly TPEx Regular/Emerging Listed Company Report

- Listed Companies Info.

- TPEx Mainboard/Emerging Stock Board Listed (Registered) Securities Issued at Flexible Face Value

- Foreign Issuer Listing (Registration) on the TPEx/ESB

- Special Information for Japanese Issuers Listing (Registering) on the TPEx/ESB

-

Emerging Stock

- The introduction to the Emerging Stock Market

- TPEx Emerging Stock Board Registration Requirements and Procedures

- Emerging Stock Trading Mechanism

- Emerging Stock

- Emerging Stock Market Report

- Trading Statistics of the Emerging Stock

- Emerging Stock Market Summary

- Market Information on the Emerging Stock

- Ex-right/ Ex-dividend

- Latest Emerging Stock Market News

- Trading halt of Emerging Stock during trading hours

- Recommended Dealers

- Market Statistics

- TPEx Mainboard/Emerging Stock Board Listed (Registered) Securities Issued at Flexible Face Value

- Foreign Issuer Listing (Registration) on the TPEx/ESB

- Special Information for Japanese Issuers Listing (Registering) on the TPEx/ESB

-

GISA Stock

-

Introduction

- Establishment Purpose of Go Incubation Board for Startup and Acceleration Firms (GISA)

- Incentives for Small-sized Companies to Apply for Registering on GISA

- Raising Capital and Investing on GISA

- Registering on GISA and Counseling Procedures

- Flowchart of GISA Registration

- Obligations for Companies Applying for GISA Registering

- Contact of Recommending Agencies

- Regulations Governing the Go Incubation Board for Startup and Acceleration Firms

- Procedures of Applications for GISA Integrative Counseling Mechanism

- Stock Purchasing and Payment Policies

- Presentation Files and Video Clips

- GISA Companies Market Summary

- Statistical Information of GISA

- Press Releases

- GISA Companies

- List of High-risk Innovative Startups

- GISA Market Announcment

- GISA Resources

-

Introduction

- Listed Open-ended Fund

- Gold

- ETF

- ETN

-

Indices

-

TPEX and Industrial Sub-Indices

- TPEX and Industrial Sub-Indices

- Guidelines for TPEX and Industrial Sub-Indices

- TPEx Index Constituents

- Today Quotes

- TPEx Index per 5 seconds

- TPEX and Industrial Sub-Indices Historical Info (Daily)

- Historical Data of TPEx Index (Monthly)

- TPEx Index and TPEx Total Return Index (Monthly)

- Industrial Sub-Indices Historical Info (Price Indices & Total Return Indices / Monthly)

- TPEx Stock Price Index Series

- TPEx Sustainability Indices

- TPEx FactSet Smart Climate Index Series

- Cross Market Index

- Taiwan Government Bond Index

- TPEx Taiwan Treasury Benchmark Index

- TPEx-BOC Offshore RMB Bond Index

-

TPEX and Industrial Sub-Indices

-

Bond

- Bond Issuance Info.

-

Bond Trading Info.

- Real-Time Trading Information

- Government Bond & Corporate Bond

- Convertible Bond

- Close Conversion Period of Convertible Bond

- Convertible Bond Information of Altered, Periodic and Suspended Trading

- International Bond

- Yield/Per-hundred Price Conversion

- Repo-Style Transaction Calculator

- Bond ETF Statistics

- Early redemption announcement of Convertible bond

- Market Announcement

- Application & Services

- Law Inquiries

- Bond Market Introduction

- Registered Foreign Bond

- Derivatives

-

Announcement & Law Inquiries

-

Market Announcement

- Market Announcement

- Announcement Download

- Ex-right/ Ex-dividend

- Capital Reduction

- Change of Par Value

- ETF Split

- ETF Reverse Split

- Default Announcement

- Announcements of capital increase/reduction by common shares by Main board /ESB companies and Announcements of TDR reissue and cancellation

- Trading Halt/ Resumption Trade

- Announcement of Attention Main Board Securities

- Announcement of Abnormal Accumulated Numbers of Attention Main Board Securities

- Announcement of Disposition Main Board Securities

- Announcement of Attention ESB Securities

- Announcement of Abnormal Accumulated Numbers of Attention ESB Securities

- Announcement of Disposition ESB Securities

- Trading halt of the Emerging Stock during trading hours

- The Securities Unusually Recommended

- Specific Abnormally Securities

- Holiday Schedule

- Announcement for Employee Stock Option certificate、Overseas Convertible Bonds、Emerging Convertible Bonds

- Law Inquiries

-

Market Announcement

- Trading Information

- Status of Application

- Listed Companies Info.

- Institutional Investor Conference

- Ex-rights/Ex-dividend

- Attention/Disposal Securities

- Investor Service

-

Investors Q&A

-

Industry Chain Information Platform

-

Bond Market Info.

-

ESG

- IFRSs/XBRL

-

Foreign Issuer Listing (Registration) on the TPEx/ESB

-

TPEx Mainboard/ Emerging Stock Board Listed (Registered) Securities Issued at Flexible Face Value

-

Anti-Financial Investment Fraud Zone

-

Securities and Futures Investors Protection Center

Investors Q&A

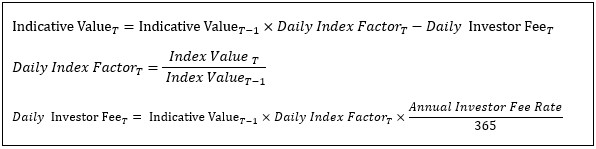

1. What is ETN’s indicative value and how to calculate it?

The indicative value means a value for an ETN, calculated by the issuer based on movements in the underlying index, accrued dividends, investor fees, and other relevant data. In principle, the formula for calculating the value of the indicator is as follows. However, the value of the indicator of the ETN designed by each securities firm will be slightly different. For the calculation method of the index value of each ETN, please refer to the ETN prospectus.

The price at which an investor buys or sells an ETN will vary depending on the method of trading. When an investor places an order through a securities broker in the secondary market, the transaction price is the market price of the ETN on the day. In addition, when an investor purchases or sells back to an issuing securities firm through a securities broker, the transaction price is the indicative value of the ETN on that day. The indicative value of each ETN is calculated in a slightly different way. Investor should read carefully the ETN prospectus.

Privacy Rights Protection Policy| Personal Information Policy| Information Security Policy| Business Continuity Management Policy