Investors Q&A

1. How long does it usually take to trade stocks on Emerging Stock Board (ESB) from the time of application for ESB registration?

I. When a public company applies for ESB registration, a consent letter will be issuedand an announcement of trading start date will be made usually in 3 businessdays (t+2) from the date of receipt of application (t), and the companyinformation will be posted on TPEx website for at least 5 business days. Thus acompany can at the earliest trade its stocks on ESB on the 9th business day(t+8) from the date of application for ESB registration.

II. When a domestic non-public companyapplies to register its stock on the ESB and together with the application italso files to conduct public issuance of the stock. In the event the companymeets all the related acts and regulations, the public issuance of the stockshall become effective 12 business days (t+12) from the date of application(t), and a consent letter will be issued and an announcement of trading startdate will be made, and the company information will be posted on TPEx websitefor at least 5 business days. Thus, a company can at the earliest trade itsstocks on ESB on the 19th business day (t+18) from the date of application for ESBregistration.

III. When a foreign company applies toregister its stock on the ESB and together with the application it also filesto conduct public issuance of the stock. In the event the company meets all therelated acts and regulations, the public issuance of the stock shall becomeeffective 12 business days (t+12) from the date of application (t). And aconsent letter will be issued and an announcement of trading start date will bemade usually in 3 business days (t’+2) after the company files the “Certificateof Registration of dematerialized Issuance” from TDCC (t’), and the companyinformation will be posted on TPEx website for at least 5 business days. Thus,a company can at the earliest trade its stocks on ESB on the 9th business day(t’+8) from the date of obtaining the “Certificate of Registration ofdematerialized Issuance” from TDCC.

2. Under what circumstances will TPEx suspend the trading of an Emerging Stock Board (ESB)? How many business days after the announcement of suspension will the stock actually stop trading?

3. Under what circumstances will TPEx terminate the trading of an Emerging Stock Board (ESB) stock? How many business days after the announcement of termination will the stock actually stop trading?

4. Under what circumstances will TPEx halt the trading of an Emerging Stock Board (ESB) stock? How can the trading be resumed?

- Trading related halt: When the difference between the average execution price of an ESB stock during the trading session and its average execution price on the previous business day reaches 50 percent or more, trading of the ESB stock will be halted till the end of the trading hours on that day, and trading will resume on the next business day.

- Event related halt: Starting March 23, 2020, if an ESB company plans to announce or call a board of directors meeting to decide on a material event under Article 37-1 of the TPEx Rules Governing the Review of Emerging Stocks for Trading on the TPEx before 5:00PM on a business day, the company should apply to TPEx for trading halt. TPEx may announce trading halt of the ESB stock as requested by the company, or TPEx may, if deemed necessary, halt on its own decision the trading of the stock in accordance with Article 37-2 of the aforementioned Rules. In principle, each trading halt lasts one trading day up to three trading days, and the ESB company may apply for resumption of trading after it has fully announced information or explained the matter relating to the halt.

5. How to inquire or learn information and list of Emerging Stock Board (ESB) stocks with trading halt?

- TPEx website:

- Search Latest Emerging Market News on trading halt/resumption of ESB stocks:

- “Emerging Stock→Latest Emerging Market News”

- “Emerging Stock→Emerging Stock Market Report”

- The market information displayed below have different color blocks to indicate respectively individual stocks that are halted trading due to an event or trading condition. Gray color represents stocks that are halted trading due to a material event, orange color represents stocks that have resumed trading, and pink color represents ESB stocks that are halted trading due to trading condition (emerging stock cooling off mechanism).

- “Emerging Stock→ Market Information on the Emerging Stock→ ESB Stocks Latest Stats”

- “Emerging Stock→Emerging Stock Market Report→Individual Stock Trading Information, Market Information by Industry or Market Comparison”

- To inquire a list of ESB stocks that are/were halted/resumed trading during a specific period of time:

- Trading related halt: “Announcement & Law Inquires →Market Announcement →Trading halt of the Emerging Stock during trading hours”

- Event related halt: “Announcement & Law Inquires →Market Announcement > Trading Halt/ Resumption Trade ”

- Search Latest Emerging Market News on trading halt/resumption of ESB stocks:

- Market Observation Post System (MOPS):

Investors can inquire information on individual stocks with trading halted under “Material Information and Announcement”; however it should be noted that an ESB company is required to announce related information within one hour after receiving a notice of trading halt or trade resumption from TPEx. So there may be some time lag in the information posted on MOPS.

6. At what time of the day can investors place orders to buy or sell Emerging stocks?

Investors can place orders to buy or sell Emerging stocks from 9:00AM - 3:00PM each trading day.

Emerging stocks are traded in a market where price negotiations are driven by quotes offered by Recommending Securities Firms (RSFs). The counterparty must be the RSFs thereof no orders can be executed between investors, besides the execution price is RSF’s quote. Thus the quotes provided by RSFs are important reference for investors when they plan to place an order. TPEx begins the display of the quotes of RSFs at 9:00AM each trading day and the Emerging Stock Computerized Price Negotiation and Click System (the "Click System") begins to accept the input of orders at 9:00AM every day. Thus to increase the chance of trade execution, investors are suggested to place orders after the quote information is displayed starting at 9:00AM.

7. Are there opening price and closing price for Emerging stocks?

8. Why there are no ex-rights/ex-dividend reference price for Emerging stocks?

9. Is there a securities transaction tax for buying and selling Emerging Stock? What is the tax rate?

10. What is the service charge for buying or selling Emerging Stocks?

11. Why the order of Emerging stocks is not executed?

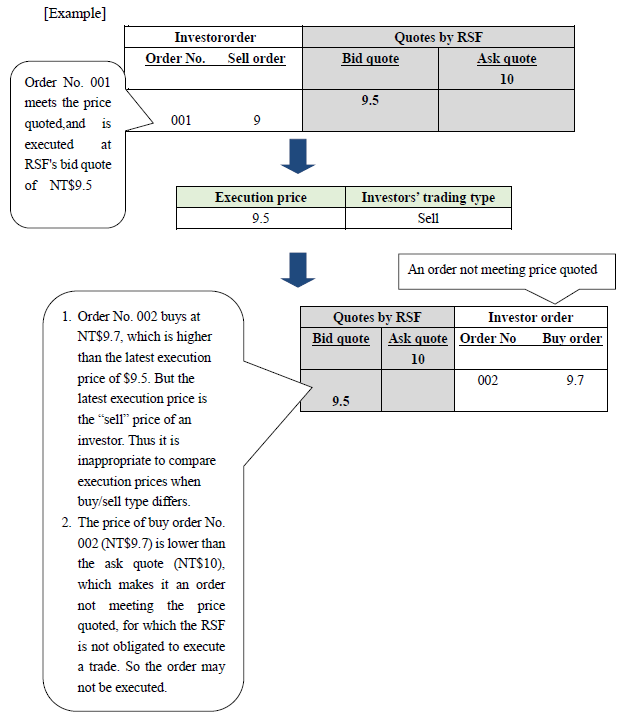

- Because Emerging stocks are traded in a market where price negotiations are driven by quotes offered by recommending securities firms (RSFs), the counterparty must be the RSF thereof no orders can be executed among investors. There must be a spread between the bid and ask quote (due to necessary operating costs required by RSFs in running the ESB stocks market making business). When an investor buys Emerging stocks, it represents that a RSF sells Emerging stocks to an investor (execution prices are ask quotes from RSFs). When an investor sells Emerging stocks, it represents that a RSF buys Emerging stocks from an investor (execution prices are bid quotes from RSFs).

- Therefore, investors should determine an execution price that is the price for investor’s buy order or sell order while referring to the execution price. TPEx’s official website’s “HOME > Emerging Stock > Market Information on the Emerging Stock > Emerging Stock Latest Stats” and “HOME > Emerging Stock > Emerging Stock Market Report > Individual stock trading information” both disclose “Investors’ Trading Types” for the reference of the public.

- For example, although an investor’s buy order is higher than the latest execution price, it could be another investor’s sell order execution price. Therefore, buy and sell orders are not suitable for comparison. Investors should take into consideration whether the RSF’s ask quote is lower than the buy order (or whether the bid quote is higher than the sell order) in order to increase the chance of execution.